Protective Trust Wills: Property and Discretionary Trusts

Are you looking to make a Trust Will for the first time?

or to amend your existing Will and include a Trust?

When we discuss making a Will with you, we adopt a consultative approach. We will listen to your needs and make recommendations based on your circumstances. We can draft your Will and help you to validate it.

Trust Wills are more powerful than basic Wills and can safeguard your assets for many years. They enable you to put in place arrangements to take care of your loved ones even after the death of your partner.

1. Property Trust Wills

In many ways, a Property Trust Will is very similar to a basic Will. It appoints Executors and specifies how your estate will be distributed on your death. Similarly, it can also contain guardianship clauses and specific gift clauses.

However, there are several advantages to be gained by including such clauses in your will to protect your assests from various scenarios. Such protection is not afforded by a simple basic Will.

If you place assets (e.g. your home) into a Trust after your death, your surviving partner cannot affect how those assets are distributed when they die. Your wishes are already in effect. You can enable your partner to enjoy the asset while they are alive and choose whom it will pass to once they die.

What does a Property Trust protect against?

Sideways disinheritance

Sideways disinheritance means that chosen beneficiaries could be side-stepped by a change in circumstances. For example, marriage revokes any Will previousy made (unless it is made in contemplation of marriage). If your assets pass into a trust after your death, your surviving partner cannot affect how those assets are distributed once they die. Your wishes are already in effect. You can enable your partner to enjoy the asset

while they are alive and choose whom it will pass to once they die, for example children or grandchildren.

Simple Scenario: Mr & Mrs Smith make Mirror Wills together leaving everything to each other and then on to the children. Mrs Smith dies and Mr Smith inherits everything. After five years he remarries. His new wife has a son from a previous marriage. The act of marriage revokes any Wills in place so they both need to make a new Will. They make a Mirror Will leaving everything to each other and then to the children equally. Mr Smith dies and his surviving spouse inherits everything. She later changes her Will leaving everything to her son. On her death Mr Smith's children do not inherit at all (sideways disinheritance).

A PTW would have prevented this from happening and ensured all children would have benefitted from their parent's estate.

Long-term care

After your death, if your surviving partner goes into care, you can ensure that the assets that belong to you

are not available for payment of your surviving partner’s care costs. You can thus preserve your assets for

your chosen beneficiaries. A family home in this position also has the advantage of being difficult to value

for means testing and may be ignored by the local authority.

In certain circumstances, it may be appropriate to include a Discretionary Trust (DT) in a Will. The trustees will decide when to distribute assets or income out of the trust and how much a beneficiary will receive, if anything. Such circumstances could include:

• Beneficiaries going through divorce or bankruptcy.

• Vulnerable beneficiaries and those with disabilities who may loose state benefits if they inherit amounts over the permitted thresholds. Income from the trust fund could be ‘drip-fed’ to them whenever needed.

Whilst assets are held in a DT they do not belong to the beneficiaries and are protected.

Joint and Single Owned Property - How it affects inheritance

Joint ownership

Any asset that is jointly owned, such as a house or a bank account, passes automatically to the survivor on the death of a joint owner. For some clients this will be what they want to happen, but consideration must be given to the threat of ‘sideways disinheritance’.

It is always possible that the joint owner will remarry and want to share assets with their new family, or inadvertently leave them to a new spouse because they have not made a new Will. Wills are automatically revoked on marriage. If there are children from previous marriages the survivor may decide to prefer their own children over their former partner’s, or they may just be persuaded to alter their Will in someone else’s favour.

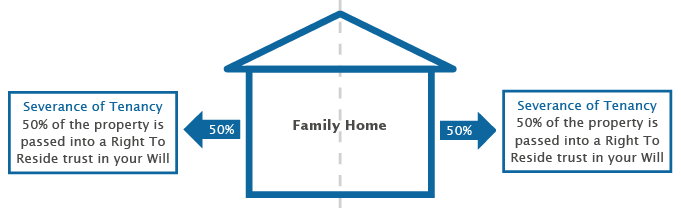

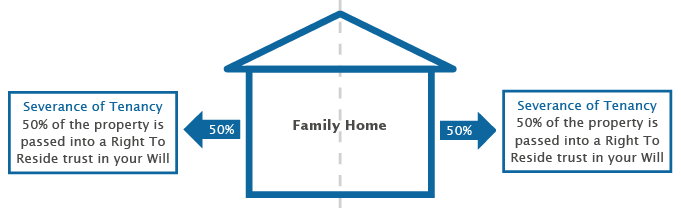

By ‘severing the tenancy’ of a jointly owned property, and preferably registering this with the Land Registry so that each party owns a defined share (usually 50:50), that share can be left only to the beneficiaries they have chosen in their Will.

We would apply to HM Land Registry on your behalf. Once the joint tenancy is "severed" you would become tenants in common.

The survivor can be granted the ‘right to reside’ in the property for a fixed term or for their life, or until they go into care. They can usually downsize if they want to, but it must eventually pass to the specified beneficiaries you have chosen in your Will.

Single ownership

If you want to ensure particular assets go to particular people after your death you must make a Will. If you want someone to benefit from an asset (perhaps by living in your home after your death or getting the income from an asset) but don’t want them to own it outright or be able to sell it, then your Will can contain a ‘term interest’, ‘life interest’ or ‘discretionary trust’. You can give directions about who the asset eventually passes to and when.

If one or more of your potential beneficiaries is disabled a vulnerable beneficiary trust can be established which has certain tax advantages and can protect any means-tested benefits they are in receipt of. It is important to take specialist tax advice in these circumstances as there can be an effect on the beneficiaries’ tax as well.

What are the disadvantages of "severing" a joint tenancy?

Need for probate

By changing the equitable ownership of your property from "joint tenants" to "tenants in common" you may

increase the need for the property to pass through probate on the first death. New mortgages and equity

release plans may not be available in respect of properties held in trust.

Surviving spouse does not automatically inherit the asset held in trust

You should also consider that you and your partner will both lose the right to automatically inherit the

property on the death of the first partner. Instead, you will each be dependent on the other to

leave you a right to reside in it. In this respect it is important to note that anyone can amend or revoke

their own Will at any time.

Long-term Care provision

Just giving your assets outright to family in the hope of avoiding the costs of long-term care is not effective or lawful. We do not advise gifts of property or assets for the purposes of avoiding care fees. Should a surviving spouse require care then the whole estate including the family home will be assessed and used to pay for it.

Loss of means tested benefits

If the recipient of your gift is in receipt of state benefits then these benefits could be lost. Discretionary trusts should be considered to protect vulnerable persons with certain medical conditions.

What do I do next?

Even if you have a Will already, you should review it periodically to make sure it meets your needs. If you would like to discuss Property Trust Wills please call us to arrange an appointment and we will visit you at home to discuss your situation.

Call 0115 981 0900 (Nottingham) or 01733 627 080 (Peterborough) for a FREE home visit